Application for the loan And you will Preapproval: A short while

- Posted by admin

- On iulie 12, 2024

- 0

This is often where in fact the procedure may held up, slowing down the closing. Make sure to stay on finest off communications from the lender and provide her or him all the details they’re asking for immediately to keep that which you moving collectively.

Really lenders use software you to definitely runs all of this recommendations and you may find whether your qualify for that loan. This might be titled automated underwriting. Automatic underwriting facilitate streamline and you will standardize the latest underwriting and you will recognition techniques.

For those who have book affairs, particularly a finite credit history, the lending company might need to manually underwrite the loan, and therefore simply implies that a man completes the entire process of underwriting, in the place of inputting recommendations on a utility.

The fresh new Underwriting Acceptance Process Divided

Let us security what the full financial process looks like, of app to closing, and watch the length of time each step often takes and just how underwriting suits with the that process.

When you first submit an application for a mortgage, you can normally bring a lot of factual statements about your finances. You’re questioned to include files exhibiting your earnings, your coupons, the money you owe and every other pointers that may relate to your money. You will additionally give the financial consent to consider your own borrowing from the bank background and you can get.

The lender will look anyway this particular article and find out whether, according to the advice you given, your satisfy their certification for getting a loan. This can usually capture less than a week to do.

So far, you can acquire a beneficial preapproval letter on financial claiming exactly how far they have been happy to lend your predicated on debt reputation. This can help you understand their finances if you are hunting to have a property. Checking out the preapproval procedure prior to starting your fixed rate loan hunt often help you produce now offers with confidence, and will help you work out one kinks on your application prior to going from underwriting procedure, which will help save time after you’ve discovered your next domestic .

Get approved to acquire a home.

Once you have found the home you would like, possible build a deal and you will discuss it to your provider. Whether or not it most of the ends up, possible each other indication the acquisition agreement and you will be below price to shop for one to household.

Assessment And you can Valuation: Each week Otherwise Reduced

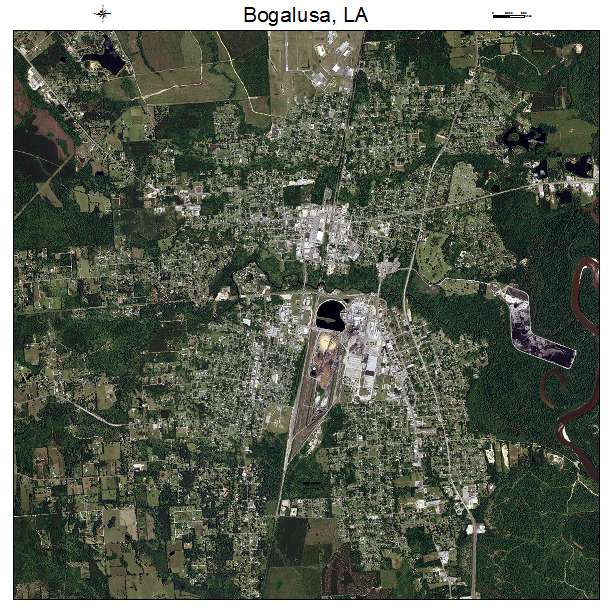

Your lender tend to acquisition the latest assessment. An authorized, third-cluster appraiser will create an assessment report predicated on a physical examination of the interior and you will outside of your subject possessions as the better since the conversion cost away from has just marketed properties that will be just as the property these are generally appraising.

This statement will include new appraiser’s viewpoint of your home’s fair market price. Which entire process fundamentally requires weekly otherwise less.

New assessment is vital to the brand new underwriting process. Knowing the house’s real worthy of, as compared to selling price, helps the brand new underwriter estimate the mortgage-to-value ratio (LTV) and ensure the borrower enjoys sufficient profit their offers to pay for an acceptable downpayment.

Get together Documentation And you may Underwriting: A short time To a few Weeks

While the information on your loan and you will application have been wishing, an underwriter can look more every facet of your document and you will verify that your qualify for the borrowed funds and this the financial institution isn’t taking on excessive exposure from the lending for your requirements.

Maybe you have defaulted for the mortgages in past times? Have you got a strong reputation of and make towards-date obligations repayments? What is actually your credit rating? They are the variety of questions they’ll certainly be seeking to respond to.

Underwriters need to know that obligations-to-money (DTI) ratio isn’t really too high which you yourself can find it difficult affording your own month-to-month payments. They are going to plus make sure to possess some more cash available, called supplies, that you may possibly use to shelter the mortgage payments for people who would be to abruptly eradicate your own source of income.

0 comments on Application for the loan And you will Preapproval: A short while